BNM decision to affect Malaysian ringgit’s fate this week

KUALA LUMPUR, MALAYSIA - Media OutReach - 9 March 2023 - Over the past year, Malaysian ringgit (MYR) has been one of the most resilient currencies among the major 10 Asia currencies that we track.

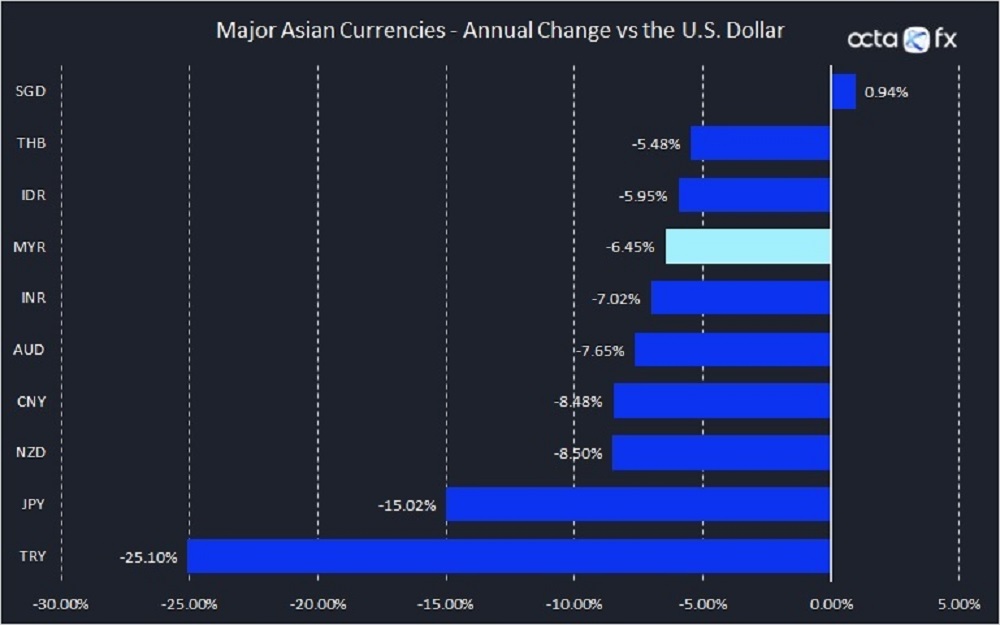

As the Federal Reserve (Fed) started to tighten monetary policy in March last year to rein in inflation, so risk-sensitive currencies began to decline. However, MYR only lost 6.5% over the past 12 months, outperforming even the global majors, such as the Japanese yen and the Australian dollar, which devalued by 15% and 7.7% respectively (see the chart below).

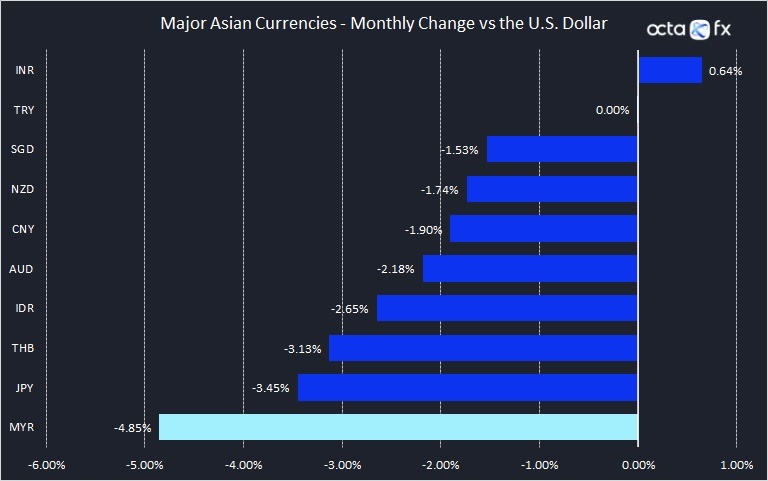

However, things started to turn sour in February. Over the past month, MYR has been the worst-performing currency among the 10 major Asian currencies that we track (see the chart below). Indeed, MYR has risen above all key moving averages and closed at 4.4730 against the U.S. dollar (USD) on Friday, setting a new three-month high. Meanwhile, the ringgit also traded mostly lower against its Asian counterparts. It eased versus the Singapore dollar (SGD) to 3.3255/3269 from 3.3210/3252 set on Thursday, fell against the Thai baht (THB) to 12.8998/9105 from 12.8583/8789 previously, and depreciated vis-a-vis the Philippine peso (PHP) to 8.16/8.17 from 8.13/8.14.

The ultimate reason for the general decline in most Asian currencies is essentially the same. Investors have turned bearish on riskier assets, such as emerging markets' debt, after the Fed indicated that it would continue hiking interest rates for longer. Rising U.S. Treasury yields due to the Fed's hawkish stance on monetary policy are making riskier assets less attractive.

'The relative underperformance of MYR vis-a-vis other Asian currencies is primarily attributable to the fact that Bank Negara Malaysia (BNM) has been rather cautious in its approach to monetary policy during the current tightening cycle,' explained Kar Yong Ang, a financial market analyst at OctaFX

Indeed, BNM has hiked the rates by only 100 basis points since May and its benchmark interest rate, which currently stands at 2.75%, is still among the lowest in the region. The last hike took place in November last year and Malaysian monetary policy tightening has been essentially on pause ever since. Thus, the divergence between the U.S. and Malaysian monetary policies widened, putting a downward pressure on MYR.

This week should be rather decisive for MYR as BNM's monetary policy committee will meet to decide on the overnight policy rate on March 9. The market seems to expect BNM to keep the rates unchanged, but in our opinion, a hawkish surprise is quite probable. Two factors are making a rate hike more likely this time around:

- No signs of a recession. China, one of Malaysia's top trading partners, recently recorded a very strong growth in its manufacturing and services sectors. According to NBS Purchasing Managers' Index (PMI), China's manufacturing activity expanded at the fastest pace in more than a decade in February 2023, as production zoomed after the lifting of COVID-19 restrictions late last year. In addition, a private survey showed that China's services PMI advanced to 55 in February, signaling more vigorous expansion in the sector.

- The Fed remains hawkish. Traders are now pricing in at least three more 25-basis point rate (bps) hikes from the Fed this year, with rates peaking at 5.43% by September. In other words, the Fed is all but certain to raise rates at its next meeting on March 22.

'It looks prudent for the BNM to hike the rates preemptively in order to offset the negative impact of the hawkish Fed in advance. While forecasting future changes in interest rates is extremely difficult, I believe that BNM will undertake a forward-looking approach and will hike the rates by 25 bps this week. Furthermore, there are signs that the market itself is beginning to price in more rate hikes ahead as the yield on Malaysian 3-year government bonds has risen to 3.465%, the highest in more than two months,' the OctaFX expert Gero Azrul commented.

If BNM does increase rates on March 9, MYR will appreciate and USDMYR exchange rate will likely drop towards 4.400 and possibly below. Alternatively, if BNM decided to leave the rates unchanged, USDMYR will likely continue to trade in a sideways mode with a minor bullish tilt, targeting 4.500.

Hashtag: #OctaFX

The issuer is solely responsible for the content of this announcement.

About OctaFX

OctaFX is a global broker providing online trading services worldwide since 2011. It offers commission-free access to financial markets and a variety of services already utilised by clients from 150 countries with more than 21 million trading accounts. Free educational webinars, articles, and analytical tools they provide help clients reach their investment goals.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including the improvement of educational infrastructure and short-notice relief projects supporting local communities.

OctaFX has also won more than 60 awards since its foundation, including the 'Best Online Broker Global 2022' award from World Business Outlook and the 'Best Global Broker Asia 2022' award from International Business Magazine.