From excessive pessimism to excessive optimism - Coface Barometer Q4 2022

Efficiency gains and the slowdown in activity have led to a sharp drop in energy prices and thus a welcome slowdown in inflation. Finally, the prospect of a rebound in China in the second half of the year, albeit very uncertain, also raises hopes for the global economy. This was enough for the financial markets to go wild, reassured by the fact that the worst-case scenario is for the time being, at bay.

While we fundamentally concur, we must be careful not to become complacent. The challenges facing the global economy last year remain relevant and the multidimensional crisis we are experiencing is not about to disappear: geopolitical fragmentation, the energy crisis, climate change, epidemic risks... The transformation of the world is accelerating and generating risks that could derail the best-crafted scenarios.

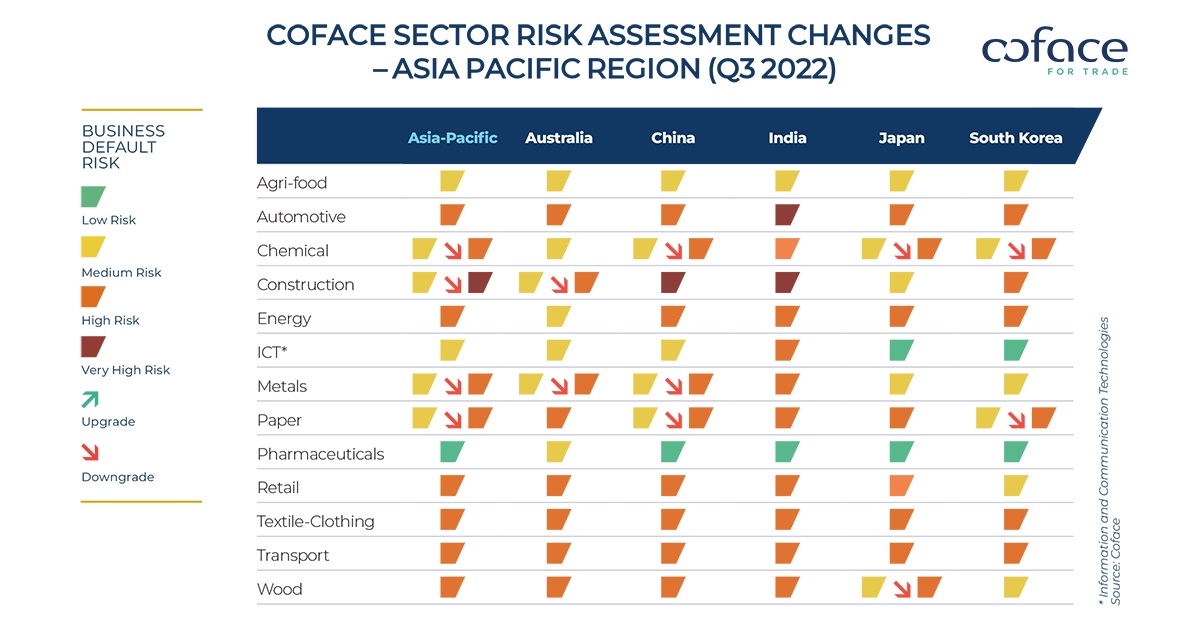

In this context, Coface's risk assessments have changed only slightly, with 5 changes for country risks and 16 changes for sector risks. In net terms, the trend remains towards downgrades.

Recession retreats, stagflation takes hold

2022 ended on a positive economic note. Mild temperatures and substantial gas reserves have removed the specter of forced rationing for Europe this winter and European economies should thus avoid a sharp contraction in activity. This has led Coface to keep its global growth forecast for 2023 unchanged at 1.9%. Our scenario of stagflation in the advanced economies and the overall resilience of the emerging countries has also been confirmed.

This continuity is reflected in our risk assessments: only 3 countries and 10 sectors are downgraded this quarter, after 95 in June 2022 and over 50 in October 2022. Meanwhile, Coface has also revised positively the assessments for India and Burundi, and six sector assessments, mainly in the automotive industry, thanks to the gradual easing of tensions in the supply chains.

Towards a (mechanical) decrease in inflation in the first half of 2023

While the surge in energy prices was at the root of the spike in consumer prices in the advanced economies, their moderation led to a mechanical decline in inflation by the end of 2022. Inflation thus seems to have passed its peak in the euro zone. This is also the case in the United States, where it reached 6.5% in December after peaking at 9.1%. Beyond the moderation of commodity prices, the fall in inflation is also attributable to the lower contribution of goods. The slowdown in inflation is expected to continue in the first half of 2023 simply due to base effects, insofar as commodity prices will remain below the levels recorded the previous year.

Against this backdrop of relative resistance in activity, labor markets continue to show resilience, with unemployment levels still historically low. The unemployment rate even continued to fall at the end of 2022 in the Eurozone, while remaining at its lowest level for over 50 years in the US (3.5%), and has risen only slightly (from 3.5% to 3.7%) in the UK. This resilience could continue in the first half of 2023: companies, having faced historically high recruitment difficulties in 2022, may be tempted to keep their employees in spite of sluggish demand, while waiting for activity to pick up.

Risks to the global economy remain

The outlook for the global economy remains bleak for 2023, in an environment that remains both risky and uncertain. The main source of concern is the inflation trajectory. While a disinflationary trend seems to be underway, the crucial question of its landing remains. The scenario of a return to the 2% target set by the central banks in the advanced countries has not been completely buried, but the possibility of inflation stabilizing at a higher level is looming. The disinflation expected in the first part of the year could be interrupted before it reaches the levels targeted by the monetary authorities, and a resurgence of inflation in the second half of the year cannot be excluded.

The recovery in China is also a source of uncertainty. The easing of restrictions against COVID-19 in the country should lead to a recovery in Chinese consumption. But, as the sudden reopening was accompanied by a surge in infections, the rebound should be gradual. The normalization of activity could thus start at the end of the first quarter of 2023 and a firmer recovery should take place in the second half of the year, creating the perfect conditions for a new storm on the energy front and, hence, on inflation.

Sector reclassifications are back

Our sectoral assessments have changed little compared to the last barometers. However, if there are few negative changes, we have also decided to make a few upgrades that reflect the relative improvement in our economic scenario. These upgrades are in the Middle East automotive sector, where demand remains strong. In India, the improvement in the country's economic situation has led to a reclassification of the country risk assessment.

Some companies in sectors previously considered resilient - ICT and pharmaceuticals - are also experiencing difficulties. The structural issues facing pharmaceutical companies in Europe are becoming more pronounced, partly as a result of increasing pressure on government finances. ICT companies are being "caught up" by the global economic situation and remain at the heart of the trade tensions between China and the United States.

Finally, Western Europe is once again the region with the highest number of sector downgrades (5 out of 11 in total). While the near-term outlook appears less bleak, it is clearly not yet time for upgrades.

The issuer is solely responsible for the content of this announcement.

COFACE: FOR TRADE

With 75 years of experience and an extensive international network, Coface is a leader in trade credit insurance and adjacent specialty services, including Factoring, Debt Collection, Single Risk insurance, Bonding and Information services. Coface's experts work to the beat of the global economy, helping ~100,000 clients in 100 countries build successful, growing, and dynamic businesses across the world. Coface helps companies in their credit decisions. The Group's services and solutions strengthen their ability to sell by protecting them against the risks of non-payment in their domestic and export markets. In 2021, Coface employed ~4,538 people and registered a turnover of €1.57 billion.