Syfe, Singapore’s Leading Digital Investment Platform Launches in Hong Kong

- Licensed by the Hong Kong Securities and Futures Commission for Types 1, 4 and 9

- Introduces Direct Indexing Global Portfolios for Retail Investors

HONG KONG SAR - Media OutReach - 17 May 2022 - Syfe, a digital investment platform headquartered in Singapore, today announces its entry into Hong Kong. This marks the company's first market expansion since its launch in 2019. Syfe has gained tremendous success in Singapore, and is a trusted and leading brand in Singapore's growing wealthtech industry.

"There is a critical gap in the Hong Kong market for a trusted wealth partner that will transform the way people manage their money. Syfe combines proven investing strategies, technology and continuous innovation to deliver financial solutions at a fraction of the cost when compared to traditional institutions. We are very excited to bring our successful offering with a strong track record in Singapore to Hong Kong as our first market for expansion. Syfe looks forward to partnering Hong Kongers in shaping better outcomes in life through better investing," said Dhruv Arora, Founder & CEO.

"Culturally, people in Hong Kong have a high tendency to save. However, due to rising inflation and a low interest rate environment, savings in the bank may no longer live up to their expectations. With a focus on long-term wealth building, Syfe is now bringing high quality financial services made affordable and accessible for investors, helping Hong Kongers reach their important financial goals," said Yenson She, Head of Business Development of Syfe.

Licensed in Hong Kong under Types 1 (Dealing in Securities), 4 (Advising on Securities), and 9 (Asset Management), and regulated by the Securities and Futures Commission (SFC), Syfe provides investors access to institutional-level investment strategies and advisory services previously only available for the top level of high-net-worth individuals. Its leading technology also allows Syfe to deliver its high-end and personalised advisory simply through an app – all without any minimum investment balance required. Syfe's wealth experts are just a call away for any investor who requires personal guidance in planning for their financial goals.

Direct Indexing Global Portfolios for Retail Investors, Exclusively for Hong Kong

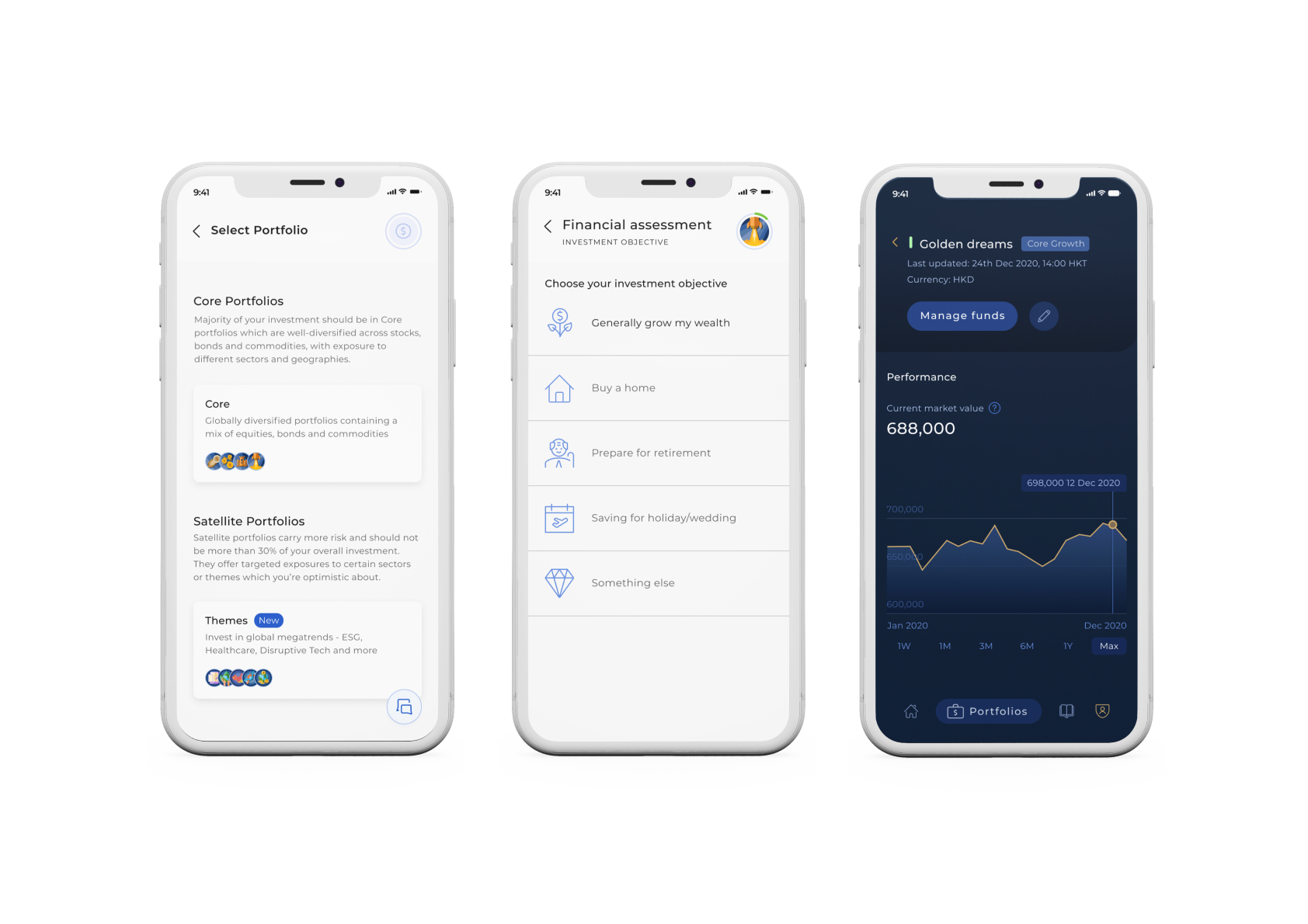

Syfe creates its own portfolios based on a passive, long-term investment strategy that minimises costs. The following portfolios are currently offered in Hong Kong:

| Core (4 portfolios) | Built for one's essential financial goals. Core portfolios maximise risk-adjusted returns by holding equities, bonds and gold in varying allocations. Each core portfolio is broadly diversified across asset classes, sectors and geographies. |

| Themes (5 portfolios) | Thematic portfolios function as satellite portfolios to complement the Core, allowing investors to have added exposure to opportunities in Disruptive Technology, Healthcare Innovation, China Growth, Global Income and ESG & Clean Energy. |

Over the last few decades, passive investing has gained massive popularity through the proliferation of index funds and Exchange Traded Funds (ETFs). As technology advances, the next evolution of passive investing has now been made possible.

Exclusively in Hong Kong, Syfe's Core portfolios leverage the direct indexing strategy for its US equity component, in place of US ETFs. The weights of individual stocks will vary according to the portfolio selected.

Through direct indexing, an investor directly owns the underlying individual stocks in their portfolio, and gains the same broad market exposure at low cost that an ETF or index fund can offer. The key benefits of direct indexing include greater transparency for investors who will be able to know exactly what they own, cost savings of up to 90% of fund fees (excluding Syfe platform fees), and reduction in the overlap of stocks. Through direct indexing, overlaps of stocks among ETFs can be reduced in a portfolio. Syfe's innovation in direct indexing is part of its commitment to finding the most efficient investment instruments to reduce costs and improve returns.

Personalised, Effortless and Affordable Investing

Syfe's fully-managed, curated portfolios enable investors to grow wealth with ease and own a portfolio with minimal upkeep. With Syfe, a person investing $10,000 or even $10,000,000 will have access to the same portfolios. Signing up and building portfolios requires no minimum investment balance, no lock-ups, and low fees starting at 0.35%-0.65% per annum. Withdrawals or inter-portfolio transfers can also be done speedily with a few taps on the app.

Clients can connect to locally-based, English and Cantonese-speaking Wealth Experts for a free initial consultation, where portfolio options can be explained in detail and questions answered. Syfe's WhatsApp and live chat function is also always available for investors' enquiries.

Safe and Secure, a Strong Track Record in Singapore

The fast-growing fintech saw a significant four-fold increase of its assets under management in the first half of 2021. Syfe's platform and its features are protected with bank-grade security, coupled with two-factor authentication through phone or email for all users. Monies and assets in investors' portfolios are held in a custodian account through an SFC licensed broker, and any uninvested cash is held in a client account at HSBC Hong Kong, regulated by the Hong Kong Monetary Authority.

"Starting today, Hong Kongers can participate in investing opportunities available in global markets and leverage Syfe's curated portfolios to grow their wealth. Having a simple, smart yet powerful digital wealth platform enabling investing at your fingertips will be a true game changer for Hong Kongers, who desire an effortless way to make their money work even harder than before. We look forward to partnering with users on their wealth journey ahead," concluded Yenson.

In Singapore, Syfe is licensed by the Monetary Authority of Singapore (MAS). Syfe has a team of over 150 people in the region and has raised a total of US$52.4 million since its launch in 2019, led by the New York-based Valar Ventures. In December 2021, Syfe launched its brokerage offering in Singapore – Syfe Trade, offering direct access to US stocks and ETFs offering free trades, fractional trading, with an easy-to-use interface.

About Syfe

Syfe Wealth offers personalised and custom portfolios, enabling users to fulfil their long-term financial goals. Grounded in the deep expertise of our financial research team, Syfe Wealth offers investment strategies for the most important goals in life, as well as access to Syfe's wealth advisors and an intuitive investing experience that is low cost and hassle-free. The platform has no minimum investment amounts and maintains a low annual fee, starting at 0.35 percent per annum of the total amount invested.

For more information on Syfe, please visit: http://www.syfe.com, and

- Syfe HK Instagram: https://www.instagram.com/syfehk

- Syfe HK Facebook: https://www.facebook.com/SyfeHongKong

#Syfe

The issuer is solely responsible for the content of this announcement.