Australia won't recover unless Victoria does too. The federal government must step up

- Written by Brendan Coates, Program Director, Household Finances, Grattan Institute

The announcement of stage 4 restrictions in Victoria marks a new, and depressing, stage in Australia’s response to COVID-19.

The new measures will close non-essential retailers and most child-care centres[1] across Melbourne, and impose stringent controls on industries such as meatworks and construction. The Victorian government estimates the measures will stop a further 250,000 workers[2] from travelling to work.

Read more: Melbourne non-essential retailers closed, as Morrison unveils pandemic leave[3]

The Victorian economy will probably be better off[4] with this sharper, hopefully shorter lockdown than persisting with Stage 3 restrictions for many months.

The federal government has taken the sensible step of announcing pandemic leave disaster payments of $1,500 for those Victorians that need to isolate for 14 days. But it will need to do more to help Victorian businesses and households make it safely to the other side.

Victoria was already struggling before stage 4

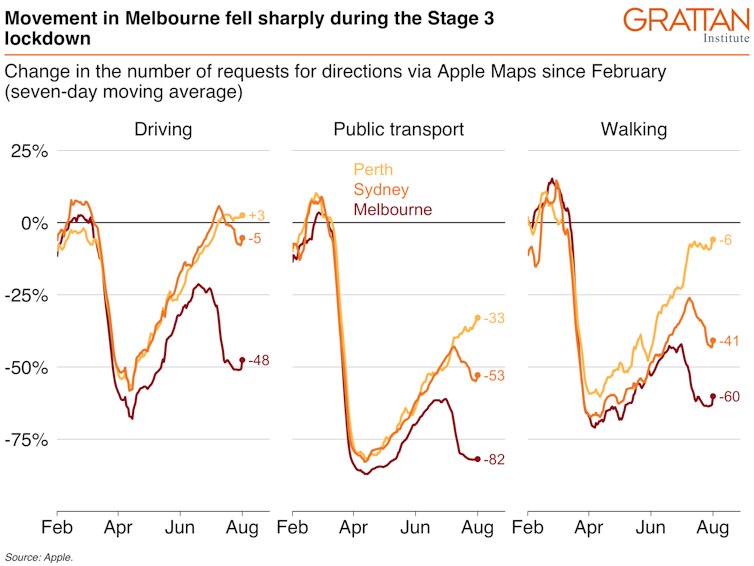

Even before Sunday’s announcement of Stage 4 restrictions, economic activity in Melbourne was back down to similar levels to the first shutdown. Movement around the city, as measured by the number of times people used Apple Maps to get directions, was about half its February level.

By comparison, in Perth (where the virus has been effectively suppressed) drivers were out and about a little more than in February. Sydney was more or less back to normal, with a slight dip at the end of July as people curtailed their movements a little. Across all three cities public transport use remains dramatically below its normal levels, with Melbourne much further away from normal than Sydney and especially Perth.

Movement in three cities.

Movement in three cities.

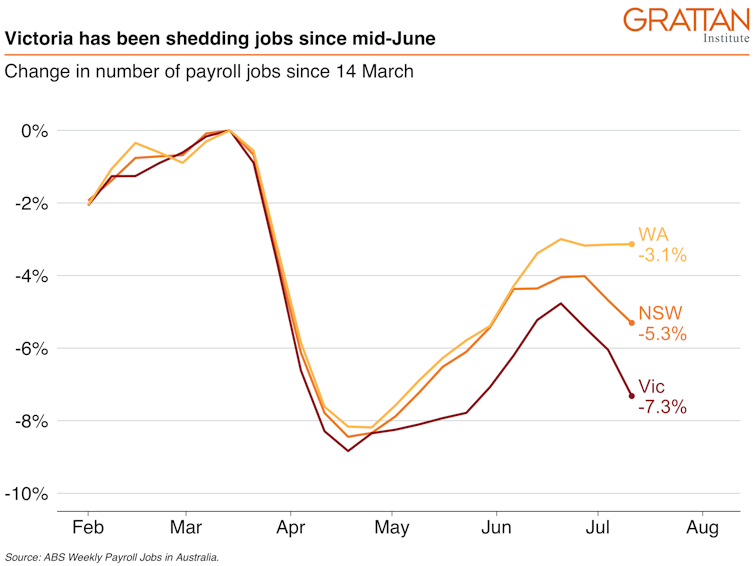

The number of jobs in Victoria was 7.3% lower[5] in mid-July than in mid-March, a deeper fall than any other state. In inner Melbourne, the number of jobs was down nearly 10% from mid-March levels. Eight of the ten federal electorates hardest-hit by job losses are now in Victoria. Without JobKeeper, the picture would be much worse.

Jobs in three states.

Jobs in three states.

Under the new restrictions on workplaces in Melbourne, employment in construction, manufacturing and retail will plummet. These industries employ about 900,000 Victorians between them. Not all of these people will be thrown out of work, but many will.

JobKeeper and JobSeeker are needed even more

The federal government should reconsider its plans[6] to begin winding back JobKeeper and JobSeeker payments after September. JobKeeper is set to fall from A$1,500 to A$1,200 for full-time workers, and to A$750 for part-timers. And JobSeeker falls from $1,215 to $815 a fortnight.

These income-support programs were absolutely necessary in March when Stage 3 restrictions were imposed. They are even more necessary now, as Stage 4 restrictions put an even tighter clamp on economic activity, stretching many businesses to breaking point and throwing more Victorians out of work.

Read more: How to get both JobKeeper and JobSeeker[7]

The “tapering[8]” of these support payments clearly cannot happen from late September, as currently scheduled.

By the end of September Victoria will hopefully be out of Stage 4 restrictions. But at best Melbourne will be back to Stage 3, the same level of restrictions for which the federal government to introduced the JobKeeper and the JobSeeker schemes.

Delivery riders in Melbourne’s deserted CBD on Sunday August 2 2020.

Erik Anderson/AAP

Delivery riders in Melbourne’s deserted CBD on Sunday August 2 2020.

Erik Anderson/AAP

The eligibility rules for JobKeeper should also be reconsidered.

Some businesses whose revenue did not fall enough to qualify for JobKeeper in March will now take a bigger hit. Other companies that qualified in March but saw a rebound in June will be excluded by the current rules from receiving JobKeeper beyond September.

The federal government COVID-19 “disaster payment” [9] should help address the crucial problem of those without paid leave entitlements being forced to choose between self-isolating and going to work to pay their bills. But the scheme is palliative rather than preventative, since it only applies in states once community transmission has ramped up to disaster levels.

Two-speed economy

The diverging fortunes of Victoria and the rest of Australia gives new meaning to the term “two-speed economy[10]”.

The federal government may be reluctant to do what’s needed just for one state, given the recovery is progressing elsewhere, but that would be a mistake. Victoria accounts for one quarter of the national economy. There is no “moral hazard[11]” here. No state is going to allow thousands of its citizens to catch a deadly virus on the expectation the federal government will turn on the fiscal taps.

The federal government should waste no time wrangling over who pays the costs of getting through the crisis. Trying to split the bill with Victoria will take valuable time, and only concentrate costs on the state hardest hit by the crisis.

Last week the federal government finalised arrangements to borrow A$15 billion through issuing 31-year bonds[12]. These bonds have a fixed interest rate of 1.94%, below the bottom of the Reserve Bank’s inflation target band.

Read more: The government has just sold $15 billion of 31-year bonds. But what actually is a bond?[13]

That means investors buying the bonds were willing to lend money to the federal government and most likely get back less, in inflation-adjusted terms, three decades from now. And investors were queuing up to buy them. In fact the government could have sold A$37 billion worth[14], rather than A$15 billion.

The federal government should use this ample fiscal firepower to ensure Victorians get through this crisis. Australia’s economy won’t recover unless Victoria does too.

References

- ^ child-care centres (theconversation.com)

- ^ 250,000 workers (www.abc.net.au)

- ^ Melbourne non-essential retailers closed, as Morrison unveils pandemic leave (theconversation.com)

- ^ better off (theconversation.com)

- ^ 7.3% lower (www.abs.gov.au)

- ^ its plans (theconversation.com)

- ^ How to get both JobKeeper and JobSeeker (theconversation.com)

- ^ tapering (theconversation.com)

- ^ “disaster payment” (www.abc.net.au)

- ^ two-speed economy (treasury.gov.au)

- ^ moral hazard (www.afr.com)

- ^ issuing 31-year bonds (theconversation.com)

- ^ The government has just sold $15 billion of 31-year bonds. But what actually is a bond? (theconversation.com)

- ^ A$37 billion worth (www.aofm.gov.au)

Authors: Brendan Coates, Program Director, Household Finances, Grattan Institute