Australia's first service sector recession will be unlike those that have gone before it

- Written by Isaac Gross, Lecturer, Monash University

Australia is on the brink of its first recession in almost 30 years.

The Australian Bureau of Statistics will deliver the official economic growth figure for the March quarter on Wednesday[1].

If it is negative (as is likely because of the downturn and the bushfires, but not guaranteed because of the surge in spending as Australians stocked up on essentials in March) and is then followed by another negative result in the June quarter (which is all but certain) Australia will be in what some people regard as a technical recession[2].

But the technicalities don’t matter. Close to 20%[3] of Australia’s labour force is either unemployed or underemployed, something that dwarfs previous recessions.

Data already released suggests it will be different in other ways; important ones with important implications.

It will be our first “service sector” recession.

Recessions are usually defined by large falls in investment; in new cars, new houses and new businesses.

Read more: Which jobs are most at risk from the coronavirus shutdown? [4]

As a result, in the early 1990s recession construction and manufacturing businesses were devastated. By contrast, employment in social services, education and food services continued to grow throughout the recession.

This time will be different.

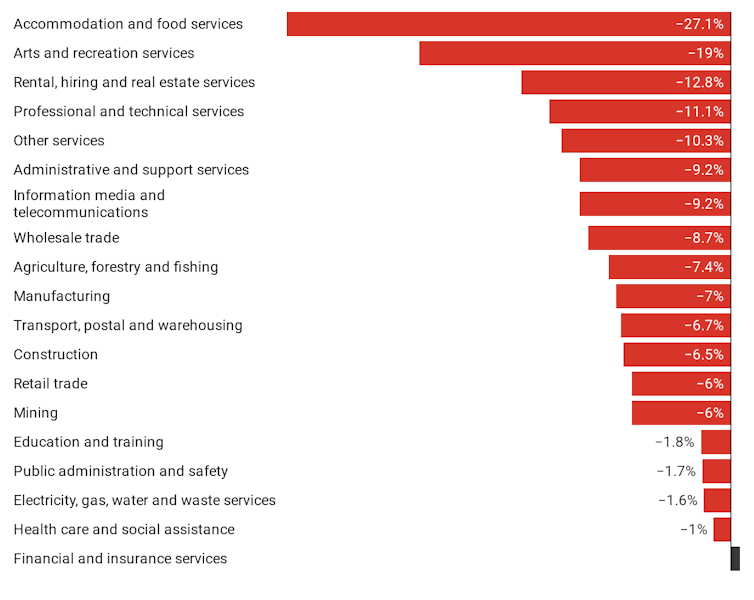

Between March 14 and May 2 some 27%[5] of the jobs in the accommodation and food services industry vanished, 19% of the jobs in the arts and recreation industry, and 11% of the jobs in professional and technical services – all well above the 6.5% and 7% of jobs lost in construction and manufacturing.

Jobs lost by industry, March 14 to May 2 ,

6160.0.55.001 - Weekly Payroll Jobs and Wages in Australia, Week ending 2 May 2020[6]

The closure of Australia’s borders coupled with the ongoing fear of infection, creates the risk that service sector job losses will continue to grow.

Even when the recession is over, they won’t bounce back in the way that manufacturing and construction jobs might have.

When previous recession temporarily slowed demand for things such as cars and buildings, the pent-up demand led to a surge in sales when incomes recovered.

Read more:

Unlocking Australia: What can benefit-cost analysis tell us?[7]

But services are harder to store over time. Someone who skips the hairdresser for a year won’t buy a year’s worth of haircuts when conditions improve.

Nor will someone who stops going to pubs (probably) buy six months worth of drinks when pubs reopen.

It means most service sector businesses can’t expect a quick rebound. Four out of every five employed Australians work in services.

The usual playbook for dealing with a recession is to target the sectors most affected. This has meant rolling out big infrastructure projects that can hire newly-unemployed construction workers, and cutting taxes to encourage businesses to expand and hire.

But that strategy won’t be as effective this time. The tour guides and massage therapists whose service sector jobs have been destroyed are ill-suited to building high-speed trains.

And a lot of infrastructure programs are designed on the basis that Australia’s population would continue to expand. With almost two thirds of Australia’s population growth driven by overseas migration and borders now closed, that is no longer certain. Many projects that were previously considered worthwhile may no longer stack up.

The government will have to focus its recovery programs on those sectors hardest hit. For some, this will be straightforward.

Read more:

Look beyond a silver bullet train for stimulus[8]

The government already plays a large role in the education industry. Universities could have their funding boosted to make up for the shortfall of international students, and domestic students should be encouraged to enrol in virtual courses to improve their skills.

For some other service industries, the government should extend JobKeeper to provide continuing assistance after it is due to end in September. Social distancing requirements are likely to limit the operations of businesses such as cinemas and theatres some time. Tourism will also remain depressed as long as our borders remains closed.

Despite the focus on mining and manufacturing in our economic discourse, Australia’s economy is overwhelmingly dominated by services.

If the government wants to stop this recession from turning into a depression, it will have to redirect its policy playbook toward services.

6160.0.55.001 - Weekly Payroll Jobs and Wages in Australia, Week ending 2 May 2020[6]

The closure of Australia’s borders coupled with the ongoing fear of infection, creates the risk that service sector job losses will continue to grow.

Even when the recession is over, they won’t bounce back in the way that manufacturing and construction jobs might have.

When previous recession temporarily slowed demand for things such as cars and buildings, the pent-up demand led to a surge in sales when incomes recovered.

Read more:

Unlocking Australia: What can benefit-cost analysis tell us?[7]

But services are harder to store over time. Someone who skips the hairdresser for a year won’t buy a year’s worth of haircuts when conditions improve.

Nor will someone who stops going to pubs (probably) buy six months worth of drinks when pubs reopen.

It means most service sector businesses can’t expect a quick rebound. Four out of every five employed Australians work in services.

The usual playbook for dealing with a recession is to target the sectors most affected. This has meant rolling out big infrastructure projects that can hire newly-unemployed construction workers, and cutting taxes to encourage businesses to expand and hire.

But that strategy won’t be as effective this time. The tour guides and massage therapists whose service sector jobs have been destroyed are ill-suited to building high-speed trains.

And a lot of infrastructure programs are designed on the basis that Australia’s population would continue to expand. With almost two thirds of Australia’s population growth driven by overseas migration and borders now closed, that is no longer certain. Many projects that were previously considered worthwhile may no longer stack up.

The government will have to focus its recovery programs on those sectors hardest hit. For some, this will be straightforward.

Read more:

Look beyond a silver bullet train for stimulus[8]

The government already plays a large role in the education industry. Universities could have their funding boosted to make up for the shortfall of international students, and domestic students should be encouraged to enrol in virtual courses to improve their skills.

For some other service industries, the government should extend JobKeeper to provide continuing assistance after it is due to end in September. Social distancing requirements are likely to limit the operations of businesses such as cinemas and theatres some time. Tourism will also remain depressed as long as our borders remains closed.

Despite the focus on mining and manufacturing in our economic discourse, Australia’s economy is overwhelmingly dominated by services.

If the government wants to stop this recession from turning into a depression, it will have to redirect its policy playbook toward services.

References

- ^ Wednesday (www.abs.gov.au)

- ^ technical recession (theconversation.com)

- ^ 20% (www.abs.gov.au)

- ^ Which jobs are most at risk from the coronavirus shutdown? (theconversation.com)

- ^ 27% (www.abs.gov.au)

- ^ 6160.0.55.001 - Weekly Payroll Jobs and Wages in Australia, Week ending 2 May 2020 (www.abs.gov.au)

- ^ Unlocking Australia: What can benefit-cost analysis tell us? (theconversation.com)

- ^ Look beyond a silver bullet train for stimulus (theconversation.com)

Authors: Isaac Gross, Lecturer, Monash University