what the treasurer's committee told him

- Written by Ben Phillips, Associate Professor, Centre for Social Research and Methods, Director, Centre for Economic Policy Research (CEPR), Australian National University

Federal Treasurer Jim Chalmers and Minister for Social Services Amanda Rishworth established an Economic Inclusion Advisory Committee in December 2022[1] to advise the government on ways to lift economic inclusion and reduce disadvantage.

I am a member of that committee, which was tasked with reporting to the government at least two weeks prior to the federal budget in May – enough time to include a response to in the budget.

The committee delivered its report to the government in late February. The goverment made it public yesterday[2].

There are 37 recommendations – too many to discuss in detail here. The most pressing concern, and the most important for immediate policy action, is to substantially increase the JobSeeker payment for the unemployed.

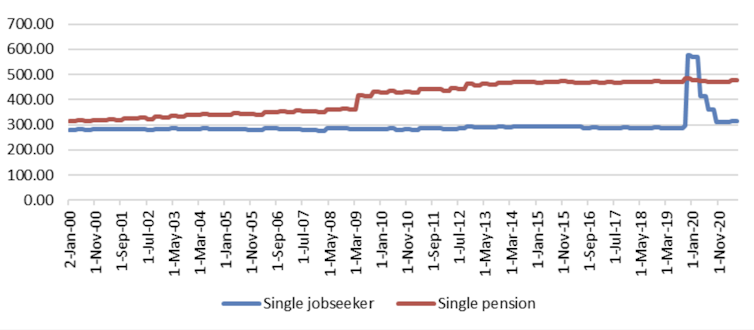

Apart from a temporary boost during the COVID-19 pandemic, the payment (previously known as the NewStart Allowance) has declined relative to median incomes and other welfare payments for several decades.

JobSeeker Payment relative to Age Pension, 2000 to 2021