Australia's system of taxing alcohol is 'incoherent', but our research suggests a single tax rate isn't the answer

- Written by Ou Yang, Research Fellow, The University of Melbourne

The best word to describe the way Australia taxes alcoholic drinks is “incoherent[1]”.

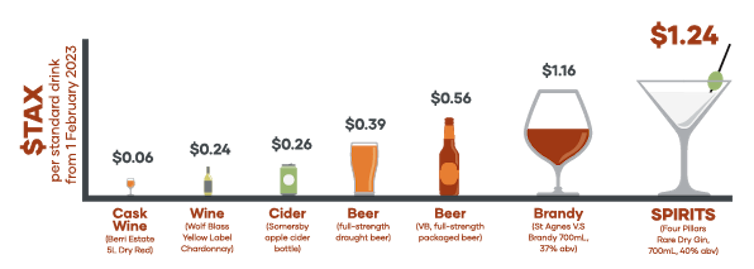

It was the word used by the 2010 Henry Tax Review[2] to describe a system[3] in which some wine effectively faces no alcohol tax[4], expensive wine is taxed heavily and cask wine lightly, beer (but not wine) is taxed by alcohol content, brandy[5] is taxed less than other spirits, and cider[6] is taxed differently to beer.

Industry calculations suggest cask wine is taxed at as little as six cents[7] per standard drink, mid-price wine at 26 cents, bottled beer at 56 cents, and spirits at $1.24.