Invest Wisely in Term Life Insurance for Your Future

- Written by Business Daily Media

Term life insurance is a form of life insurance that provides monetary coverage for a predetermined period of time. In case of an unfortunate death during this term, a lump sum payout is made to the designated beneficiary, ensuring that their financial future is secure even in the absence of the policyholder. This type of insurance is a cost-effective method of safeguarding one's loved ones from any financial difficulties that may arise from premature death.

Term life insurance in Singapore is an adaptable and budget-friendly insurance solution, which makes it an ideal choice for individuals and families who are looking for life coverage. There are four main varieties of term life insurance policies, each with its unique advantages and disadvantages.

Level-term life insurance is the first type of term life policy. This policy provides a fixed premium rate over a specific time period, usually ranging from 10-30 years. The advantage of this policy is that the premium rate remains consistent, avoiding any inflationary costs that would otherwise arise from increasing premiums over time. However, this policy's downside is that the death benefit does not change during the policy term, meaning that additional coverage may need to be purchased if the policyholder requires more coverage later on.

Increasing-term life insurance is the second type of term life policy. This policy allows the death benefit to increase annually while maintaining a consistent premium rate throughout the policy term. Some policies even offer double or triple death benefits in the event of premature death caused by illnesses or accidents during the policy's lifetime. Despite these benefits, this type of policy can be more expensive than level-term policies due to the increasing premiums over time and the potential for cash value accumulation.

The third type of term life insurance is Decreasing-term life insurance. This policy offers a death benefit that decreases over time, often aligned with a decreasing mortgage balance. It is a more affordable option for those who have a decreasing need for life insurance coverage over time.

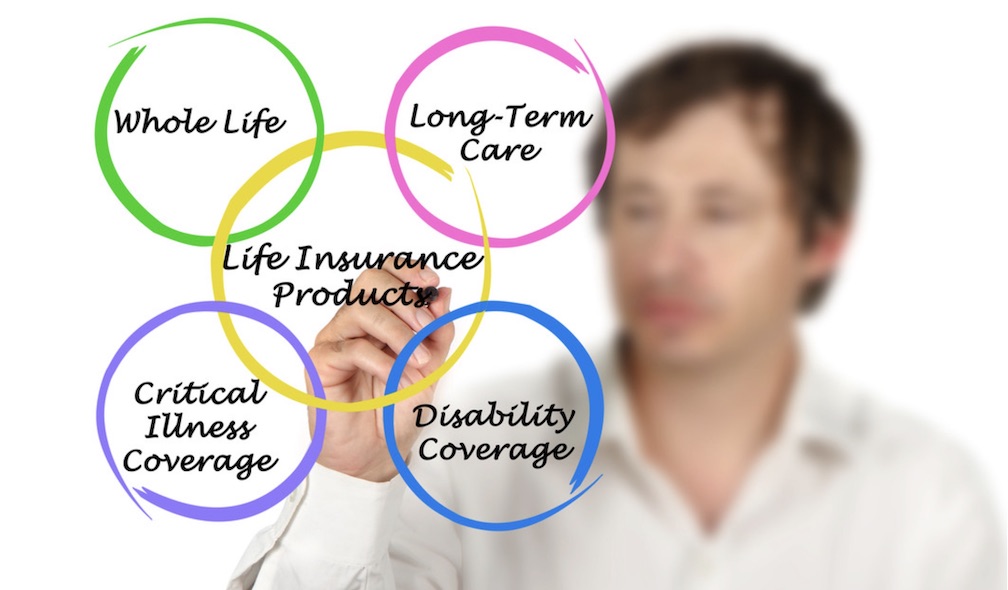

The fourth and final type of term life insurance is Convertible Term Life Insurance. This policy provides the option for the policyholder to convert their term life policy into a permanent life insurance policy, such as a whole life insurance policy, without having to undergo a medical exam. This type of policy offers flexibility and the potential for long-term coverage.

Investing in a term life insurance policy can be a wise decision for securing one's financial future and the future of their loved ones. Term policies offer coverage for a specific period, usually in increments of five, ten, or twenty years, and are generally more affordable than permanent life insurance policies. Policyholders can choose the length of protection that fits their needs and budget, giving them peace of mind in the event of an unexpected death.

Despite the advantages, there are also some potential drawbacks of investing in a term policy that should be considered. For instance, premiums on term life insurance tend to increase as the policyholder ages and becomes less healthy over time, resulting in higher costs that may eventually surpass the value provided by the policy’s death benefit.

When it comes to choosing the right type of policy, it is important to assess one's needs and determine the type of coverage that is necessary. This includes considering the events or risks that need coverage and the amount of coverage required. It is also essential to compare different policies available in the market, determining which one provides the most comprehensive coverage at an affordable rate. Researching different policies offered by competing companies can also provide valuable insight into the different options available before making a decision.

Conclusion

Term life insurance is a valuable investment for individuals who are looking to protect their loved ones in the event of their death. This type of insurance is affordable, flexible, and can be tailored to fit one's budget.