What just happened to our tax? Here's an explanation you'll understand

- Written by Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University

With all the announcements on tax over the past few days it’s hard to keep track. So here goes.

A year ago the then treasurer Scott Morrison unveiled a “seven year personal tax[1]”.

Some of it involved tax cuts way out into the future, in 2022 and 2024, with which we needn’t concern ourselves – there’ll be two, maybe more, elections before then.

The bit that was to start in mid 2018 (and did) wasn’t a tax cut at all, strictly speaking. It was an “offset” with an ungainly name: LMITO – the Low and Middle Income Tax Offset.

A standard tax cut, applying to any rate, would save money to all taxpayers on that rate and rates above it, including those on very high incomes. It couldn’t be directed to just low and middle earners, which is what the Coalition wanted.

What’s on offer isn’t really a tax cut

So the Coalition designed an offset, to be paid as a lump sum after the end of each tax year, after returns had been submitted and only to those taxpayers whose returns showed they weren’t high earners.

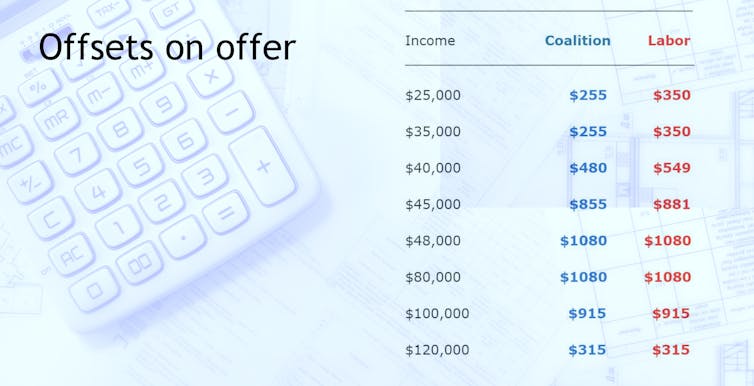

The full offset was A$530 per year, paid only to taxpayers who earned between $48,000 and $90,000. Taxpayers who earned more than $90,000 would lose 1.5 cents of it for each dollar they earned above $90,000, meaning no-one who earned more than $125,333 would get any of it.

(Taxpayers earning more than $125,333 wouldn’t go home completely empty handed - they would benefit from an increase in the point at which the the second highest rate came in, worth a barely consequential $135 a year.)

Taxpayers who earned less than $37,000 would get $200 off their tax, climbing to $530 for taxpayers earning $48,000.

It was ungainly – it was better described as a series of annual lump some payments than a tax cut – and Labor embraced it entirely.

In 2018 Labor trumped it

Except that Labor supercharged it. Under Labor it was to operate in exactly the same way, except that each payment would be 75% bigger: the Coalition’s $200 became Labor’s $350, the Coalition’s $538 became Labor’s $928 and so on.

Labor outbid the Coalition.

And these things stayed, for almost a year, except that it was all a bit academic.

Labor wasn’t in government, and the leglislated offsets weren’t to put the lump sums in pockets until after the end of June 2019.

In 2019 the Coalition trumped Labor

It allowed the Coalition to sneak in before them in Tuesday’s budget and double the maximum lump sum: $538 became $1,080, a promise Bill Shorten matched in his budget reply speech on Thursday night.

But for some reason the Coalition didn’t double everything: $200 only became $255, rather than the $350 Labor had already promised.

On Thursday night Shorten confirmed the $350 promise.

He is able to offer the 3.6 million Australians earning less than $48,000 more than the Coalition – in most cases an extra $95 more: $350 instead of $255.

Now Labor has trumped the Coalition

Shorten says it’ll cost an extra $1 billion, which is a mere fraction of the money Labor believes it will have that the Coalition won’t, because of its crackdowns on negative gearing, capital gains tax concessions and dividend imputation.

As Shorten put it on Thursday night:

Labor will provide a bigger tax cut than the Liberals for 3.6 million Australians all-told, an extra $1 billion for low income earners in this country. Here’s the simple truth - 6.4 million working people will pay the same amount of income tax under Labor as the Liberals. Another 3.6 million will pay less tax under Labor.

In fact they’ll pay just as much tax from payday to payday, but they’ll get back more at the end of the year, in most cases $95 more.

So here’s the scorecard:

Source: Australian Labor Party

Read more:

It’s the budget cash splash that reaches back in time[2]

Source: Australian Labor Party

Read more:

It’s the budget cash splash that reaches back in time[2]

References

- ^ seven year personal tax (budget.gov.au)

- ^ It’s the budget cash splash that reaches back in time (theconversation.com)

Authors: Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University