Planning a renovation or new build? Here's the outlook for skyrocketing steel and timber prices

- Written by Flavio Macau, Associate Dean - School of Business and Law, Edith Cowan University

It’s a tough time to build or renovate a house in Australia. Prices are up, well above inflation. Finding materials and getting them on time is a challenge. Builders are grappling with too much work and stress (with some folding as costs rise too fast). Customers are being confronted with eye-watering price quotes.

And as any would-be home builder or renovator knows, the price of timber or steel is crucial.

So what exactly is happening here, and what’s the outlook?

Read more: HomeBuilder might be the most-complex least-equitable construction jobs program ever devised[1]

Timber: huge demand, not enough supply

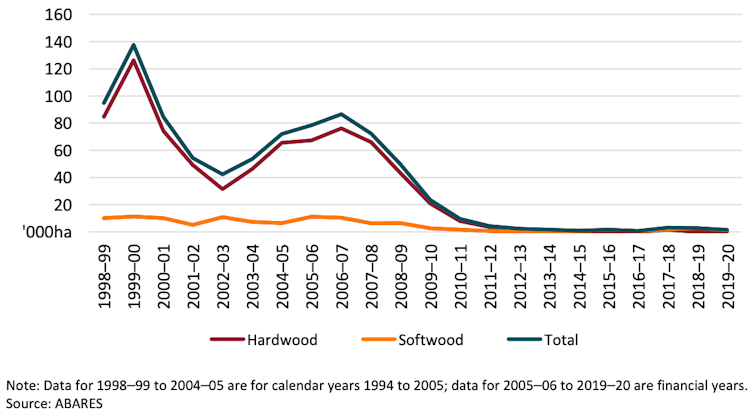

According a 2021 Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) report[2]:

average annual hardwood log availability is forecast to be 1 million cubic metres (9%) lower over 2020-24 than 2015-19 […] softwood sawlog availability is projected to be 10% lower in the period of 2020-24 than was projected in 2015.

The same report[3] shows minimal new plantations were established in recent years.

In the 2019-20 bushfires, 130,000 hectares of plantation forest were burned[5]. Recent floods didn’t help.

Native forest harvesting is also falling; it will be banned[6] in Western Australia by 2024. Victoria will phase out the industry[7] by 2030.

A timber shortage was expected as early as 2020 but the start of the COVID pandemic – when the housing market momentarily froze – brought some respite, with house construction and timber prices initially going down.

Then came HomeBuilder[8], which encouraged consumers to proceed with purchases or renovations to reignite the house construction market.

The number of dwelling units commenced shot up[9] by more than 60%, from about 41,000 by September 2019 to 67,000 by June 2021.

The stock of dwellings under construction went from about 180,000 in 2020 to more than 240,000 today.

If you are building many more houses, you need more construction materials. A mild deficit projected for 2020 has now turned into a black hole.

With less timber available, industry sees[10] a deficit of at least 250,000 wooden house frames in the next 15 years. Scarcity is the new normal.

The result is a growth in domestic prices[11] as timber processors struggle to meet contract obligations.

Logs cannot be manufactured. They grow, and this takes about 20 years. The only way to go through current shortages is by importing or replacing timber.

Importing timber isn’t cheap. Australia has very low costs[12] to grow and harvest, less than half of major global exporters. Adding to that, international shipping rates have surged[13] in the past two years.

These act as barriers to imports, which fell[14] considerably in the past decade.

Steel: supply chain woes and war on Ukraine

Steel is the typical replacement for timber. But builders and renovators will not find good news there either. Steel prices also skyrocketed[15] by more than 42% in the year ending March 2022, according to the Australian Bureau of Statistics.

Troubled supply chains have reduced supply[16] at a time of unexpectedly high demand, and investment has been scarce in recent years.

When a recovery was on the horizon, war[17] hit shipments of key stock from Ukraine and Russia.

With few players left, home builders in Australia assert[18] they’re at the mercy of a de facto monopoly by BlueScope Steel in the light gauge steel framing market.

Earlier this year, BlueScope customers had to contend[19] with a 38% price increase on steel fabrication products.

A 2021 federal government decision[20] to impose dumping duties of up to 20.9% on steel imports from Korea and Vietnam did not exactly help bring prices down.

In February 2022, BlueScope posted[21] its largest half-year profit ever.

According to its chief executive, Mark Vassella, current trends are here to stay. The company intends to make the most of current market conditions and expand its capacity, with plans to reignite a blast furnace deactivated in 2011.

What happens next?

The price outlook is grim.

Master Builders Queensland chief executive Paul Bidwell reckons material price rises may not yet have peaked[22].

There is no indication timber prices will go down again, as they did in 2020. As for steel, 2013 was the last time there was a significant price reduction.

The Australia Bureau of Statistics (ABS/HIA) recorded[23] in June this year an increase of about 40% in prices for reinforced steel, structural timber and steel beams.

Thanks to the housing construction boom, building projects now face delays[24], which further drives up construction costs[25].

Several builders have gone broke[26]. Those under a fixed-price contract who factored low material prices[27] into their quotes are now facing the hard truth of working for little or no profit, or even at a loss.

Will construction prices come down? One can only hope – but it’s unlikely to happen anytime soon.

Read more: What's causing Australia's egg shortage? A shift to free-range and short winter days[28]

References

- ^ HomeBuilder might be the most-complex least-equitable construction jobs program ever devised (theconversation.com)

- ^ report (daff.ent.sirsidynix.net.au)

- ^ report (daff.ent.sirsidynix.net.au)

- ^ ABARES (daff.ent.sirsidynix.net.au)

- ^ burned (daff.ent.sirsidynix.net.au)

- ^ banned (www.theguardian.com)

- ^ industry (www.smh.com.au)

- ^ HomeBuilder (treasury.gov.au)

- ^ shot up (www.abs.gov.au)

- ^ sees (www.timberindustrynews.com)

- ^ domestic prices (www.ibisworld.com)

- ^ costs (link.springer.com)

- ^ shipping rates have surged (www.bloomberg.com)

- ^ fell (www.agriculture.gov.au)

- ^ skyrocketed (propertyupdate.com.au)

- ^ supply (www.mitre10.com.au)

- ^ war (www.bloomberg.com)

- ^ assert (www.smartcompany.com.au)

- ^ contend (www.smartcompany.com.au)

- ^ decision (www.globaltradealert.org)

- ^ posted (www.illawarramercury.com.au)

- ^ peaked (www.abc.net.au)

- ^ recorded (www.abc.net.au)

- ^ delays (sustainableforestmanagement.com.au)

- ^ costs (www.fwpa.com.au)

- ^ broke (www.afr.com)

- ^ prices (www.fwpa.com.au)

- ^ What's causing Australia's egg shortage? A shift to free-range and short winter days (theconversation.com)

Authors: Flavio Macau, Associate Dean - School of Business and Law, Edith Cowan University