Traditional culture may help Indigenous households manage money better

- Written by Robert Breunig, Professor of Economics and Director, Tax and Transfer Policy Institute, Crawford School of Public Policy, Australian National University

Few areas of public policy are as hotly debated as how to close the income gap between Indigenous and non-Indigenous Australians. There are some uncontroversial goals, such as improving job opportunities and reducing the high rate of Indigenous unemployment. But other ideas to better target welfare are bitterly divisive.

The cashless credit card, for example, has been described as a vital response to the problem of welfare policies[1] that systemically enable illicit drug use, alcohol abuse and gambling. It has also been called the epitome of neocolonial and punitive policy[2] implemented for some imagined political gain at the expense of vulnerable people.

Both assessments may be valid, given the context. One of the problems with Indigenous welfare policy is an oversupply of assumptions and a lack of detailed information about the realities of lived experience.

Read more: How to get a better bang for the taxpayers' buck in all sectors, not only Indigenous programs[3]

It is generally assumed, for example, that the patterns of why people in Australia are poor, and how they manage the money they have, are largely the same for Indigenous and non-Indigenous. But this might be incorrect.

We decided to dig into the statistics and compare the experience of financial stress in Indigenous and non-Indigenous households.

Our findings surprised us.

While financial stress is much more common in Indigenous households, we found evidence of substantial capacity to manage scarce resources. Indigenous households in remote areas seem to manage better than those in urban areas. Large Indigenous households do better than non-Indigenous ones.

We are hesitant to draw any grand policy conclusions, except to underline a clear truth: those in the field of Indigenous policy need to base their decisions on accurate information, lest they undermine the capabilities and strengths that people already possess.

Defining financial stress

Financial stress is a relative experience. It’s not just about income level, but how individuals or households cope. The degree of stress can be different for two people on the exact same income, depending on the choices they make.

The Australian Bureau of Statistics defines a range of indicators to determine financial stress. Spending more than your income is one. Being unable to pay power and phone bills is another. Going without meals and not having money to heat your home are two others.

We split financial stress into “cashflow” (inability to pay housing costs or utilities or borrowing from friends) and “hardship” (missing meals, pawning something, not being able to pay to heat the home or applying for welfare) problems. These two types of problems are fundamentally different. Hardship problems are rarer and more likely to be associated with severe disadvantage.

We then devised a method to better compare the experience of these two forms of financial stress in Indigenous and non-Indigenous households. For this we use two large surveys covering more than 12,000 households: the Household Income and Labour Dynamics in Australia (HILDA) and the 2014-15 National Aboriginal and Torres Strait Islander Social Survey (NATSISS).

Cashflow stress

Indigenous households experience more cashflow problems than comparable non-Indigenous households, even when we control for income and other household characteristics.

That is, an Indigenous household with the same income as an average non-Indigenous household is more likely to experience cashflow problems – in some cases substantially so.

There is evidence this financial stress is exacerbated by the widespread demand-sharing custom known as “humbugging”. An Indigenous person is more likely, for example, to let someone else use their ATM card.

Hardship

Yet when it comes to the more extreme form of financial stress, Indigenous households are at least as effective as non-Indigenous households at avoiding hardship.

That is, while Indigenous households experience more financial stress – because they have, on average, much lower incomes – our model indicates an Indigenous household with the same income as the average non-indigenous household has the same or smaller probability of experiencing financial hardship.

Remote households

Our modelling also shows Indigenous households in remote and very remote areas appear to do better at avoiding financial stress than counterparts in non-remote areas.

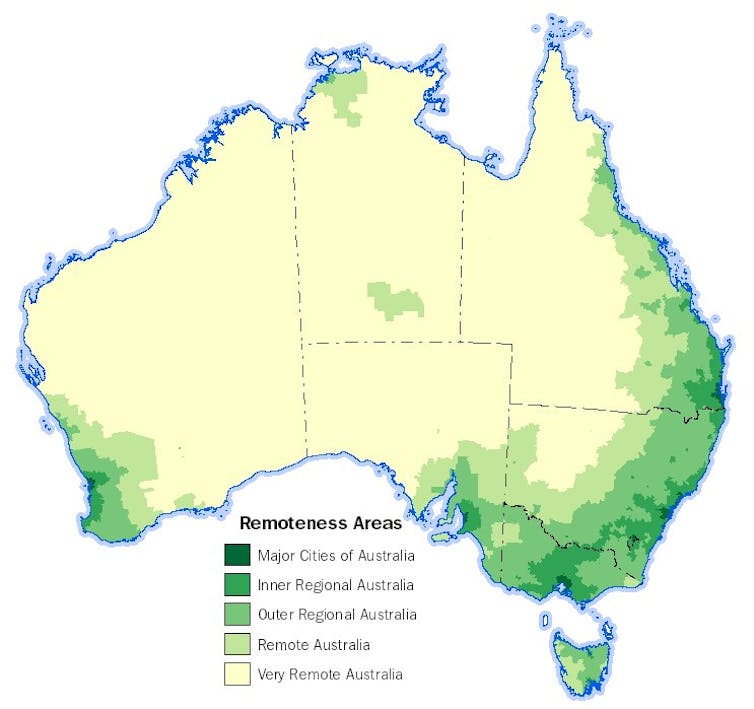

The ABS uses five classes of remoteness based on relative access to services.

ABS[4]

The ABS uses five classes of remoteness based on relative access to services.

ABS[4]

Again, while remote households have, on average, much lower incomes – and therefore more financial stress – our method is able to show that a remote household is less likely to experience financial stress than a non-remote household with the same income.

This suggests there is value in traditional practices for Indigenous households.

Large households

Finally, large Indigenous households seem to manage better than large non-Indigenous households. As household size grows, Indigenous households need less extra income to have the same probability of experiencing financial stress.

This is significant because it suggests policies that encourage better sharing of resources among large extended family groups could be a highly efficient social insurance mechanism.

Interestingly, the presence of multiple families in a household has no significant effect on the probability of experiencing financial stress. This contradicts the policy assumption that multiple families in a house makes things worse.

Read more: FactCheck Q&A: is $30 billion spent every year on 500,000 Indigenous people in Australia?[5]

Overall our research suggests Indigenous people, particularly those in remote areas, have substantial capacity to manage scarce financial resources. Policy makers need to leverage these capabilities through implementing policies that support and enhance them.

References

- ^ vital response to the problem of welfare policies (theconversation.com)

- ^ neocolonial and punitive policy (theconversation.com)

- ^ How to get a better bang for the taxpayers' buck in all sectors, not only Indigenous programs (theconversation.com)

- ^ ABS (www.abs.gov.au)

- ^ FactCheck Q&A: is $30 billion spent every year on 500,000 Indigenous people in Australia? (theconversation.com)

Authors: Robert Breunig, Professor of Economics and Director, Tax and Transfer Policy Institute, Crawford School of Public Policy, Australian National University