Labor's costings broadly check out. The days of black holes are behind us, thankfully

- Written by Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University

Is there a “big black hole” in Labor’s election costings? It’s unlikely.

The final campaign before the arrival of the Parliamentary Budget Office[1] in 2012, the 2010 Gillard versus Abbott contest, was full them.

Abbott was in opposition, Joe Hockey was his treasury spokesman. A treasury analysis[2] of the costings document he produced, delivered to the newly-elected independent members of parliament to help them decide who would form government found errors including double counting, purporting to spend money from funds that sweren’t there, using the wrong time period to calculate savings, and booking debt interest saved from a privatisation without booking the dividends that would be lost.

All up, the mistakes were said to amount to A$11 billion[3].

Opposition costings used to be awful

In order to give his calculations a veneer of respectability Hockey engaged two accountants from the Perth office of a firm then known as WHK Horwath and wrongly said they had audited them[4].

“If the fifth-biggest accounting firm in Australia signs off on our numbers it is a brave person to start saying there are accounting tricks,” he told the ABC. “I tell you it is audited. This is an audited statement.”

It wasn’t. The letter of engagement later seen by Fairfax Media explicitly said the work was “not of an audit nature”. Its purpose was to “review the arithmetic accuracy” of Hockey’s work.

The Institute of Chartered Accountants later fined the two accountants who it found had breached professional standards by allowing their work to be represented as an audit[5].

Three years on, with the Parliamentary Budget Office in place, Hockey’s costings were comparatively controversy-free, as were Chris Bowen’s when Labor was in opposition in 2016.

Now, they’re fairly controversy-free

Costings have become straightforward. The Parliamentary Budget Office prepares the best possible estimate of the cost of each policy, then a panel of eminent Australians goes over its calculations and adds the costs together.

Labor’s panel this time was the same as its panel last time: Professor Bob Officer, who chaired the commissions of audit for the Howard and Kennett Coalition governments, Dr Michael Keating, who used to head the department of prime minister and cabinet and finance under the Hawke and Keating governments, and company director James MacKenzie.

They found the Parliamentary Budget Office costings to be “of a similar quality as budget estimates generally[6]”.

They provided “a reasonable basis for assessing the net financial impact on the Commonwealth budget”.

Labor’s costings are propped up by savings

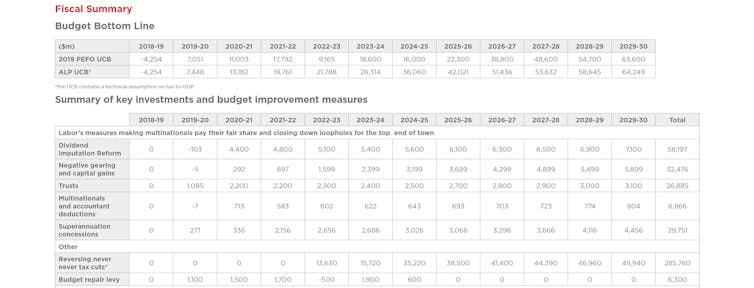

That impact was a return to “strong surplus” of $22 billion under Labor in 2022-23, four years ahead of the Coalition, in a year which the Coalition is forecasting a surplus of less than half the size – $9.2 billion.

Extract from Labor’s costings document.

Australian Labor Party[7]

Extract from Labor’s costings document.

Australian Labor Party[7]

Labor is able to do it because it will raise (or avoid spending[8]) more than the Coalition. Over ten years it will save

$58 billion by winding back payouts of dividend imputation cheques to people who don’t pay tax

$32.5 billion by winding back negative gearing and capital gains tax concessions

$29.8 billion by reducing superannuation tax concessions

$26.9 billion by more fully taxing trusts

$6.9 billion by cracking down on multinational tax avoidance and the use of high fees for tax advice as tax deductions, and

$6.3 billion from reintroducing for four years the Coalition’s temporary budget repair levy of 2% on the part of high earners’ income that exceed $180,000

Treasurer Josh Frydenberg attacked the costing saying Labor had confirmed “$387 billion in higher taxes; higher taxes on retirees, higher taxes on superannuants, higher taxes on family businesses, on homeowners and renters and low-income earners,” which it had, although it had hardly been a secret.

The tax measures are how Labor builds its bigger surpluses.

The best an opposition can produce

Frydenberg said Labor had failed explain the “economic impact these higher taxes will have across the economy”, a charge Labor had responded to earlier by saying that wasn’t a service the Parliamentary Budget Office provided.

It was work the treasury was able to do, but the resources of the treasury weren’t available to the opposition.

Besides which, a fair chunk of those savings would be spent, on programs such as Labor’s Medicare cancer plan, its pensioner dental plan, extra hospital funding and greater childcare subsidies. They would boost the economy.

Unlike the Coalition, Labor isn’t locking in tax changes years out into the future (although its costings set aside $200 billion for extra tax cuts at some point over the next ten years); it is giving itself flexibility in order to manage the economy as needed when the time came.

Read more: Why Labor's childcare policy is the biggest economic news of the election campaign[9]

Frydenberg identified as the “big black hole in Labor’s costings”, what he said was its “failure to account for the increase in spending that they have promised with changes to Newstart, to aid, to research and development”.

Four years out is conventional

It wasn’t much of black hole. Labor has not promised changes to the Newstart unemployment benefit – it has instead promised to review it. Without the result of the review or without an indication of how much Newstart might be lifted or when it would be lifted, it’d be a hard thing to cost.

Frydenberg’s other beef was with programs Labor’s document costed in detail for four years but not in detail for ten. But that is how his own budget presented its figures. It’s how every previous budget has presented its costings.

Since the late 1980s it’s been the convention to cost programs in detail only four years ahead[10]. Before that, the budget convention was to cost programs in detail only one year ahead.

Read more: Mine are bigger than yours. Labor's surpluses are the Coalition's worst nightmare[11]

It is possible that Labor’s costings document is less than perfect. It is possible that the three eminent Australians who lent their names to it have been hoodwinked. But the contours of the document are clear. Labor will tax more and spend more than the Coalition, and deliver bigger surpluses.

But it only plans to tax more up to a certain point: 24.3% of gross domestic product, which was the tax take in the final year of the Howard government. The Coalition’s limit is 23.9% of GDP, which will mean it finds it harder than Labor to build up a big surplus quickly.

The days of black holes are behind us, thankfully.

References

- ^ Parliamentary Budget Office (www.aph.gov.au)

- ^ treasury analysis (www.theage.com.au)

- ^ A$11 billion (www.abc.net.au)

- ^ and wrongly said they had audited them (www.smh.com.au)

- ^ by allowing their work to be represented as an audit (www.theage.com.au)

- ^ of a similar quality as budget estimates generally (www.alp.org.au)

- ^ Australian Labor Party (www.alp.org.au)

- ^ or avoid spending (theconversation.com)

- ^ Why Labor's childcare policy is the biggest economic news of the election campaign (theconversation.com)

- ^ only four years ahead (www.smh.com.au)

- ^ Mine are bigger than yours. Labor's surpluses are the Coalition's worst nightmare (theconversation.com)

Authors: Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University